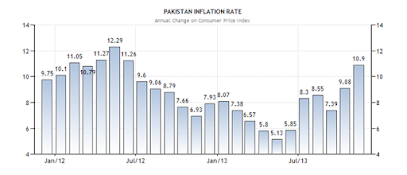

Currently, Pakistan is on the threshold of achieving a stable inflation rate. The rate is at its lowest level since the beginning of the financial crisis in 2009. However, the current situation has brought forth some challenges that must be addressed.

Energy

imports:

During the past five years, the share of imports from non-EU

countries has increased significantly. This increase was due to the

increase in fuel imports from non-EU countries. This also led to a significant rise

in consumer prices.

The overall increase in inflation is attributed to the

recent surge in energy prices. The seven-day average wholesale price of gas

reached 15.3 pence per kilowatt hour in March 2022, which is nine times higher

than the average price in the previous year. This is even though gas

imports are similar to the earlier years.

The government of Pakistan introduced agriculture assistance

policies after a poor harvest in 1993. Since then, the economic importance of

the agricultural sector has decreased. During the past four years, the

government spent over one trillion rupees on poverty alleviation programmes.

Agriculture:

Pakistan's agricultural and global inflation rates from 2018 to 2022 are expected to

remain high. The FAO Food Price Index averaged 135.9 points in October 2022.

Increasing food inflation is expected to reduce the real purchasing power of

households. This is a significant concern in the world.

|

| Image Resource |

During the Derg administration, agricultural output

proportion in GDP declined from 70 per cent in 1960/61 to nearly 50 per cent in

1973/74. Despite a drop in contribution to GDP, agriculture is still an

important sector in the country.

While the industrial sector plays a vital role in reducing

inflation in the short run, the agricultural sector is more effective in

reducing inflation among the poor. Hence, the government should focus on

enhancing the input financing for the farm sector. In addition, the

government introduced a targeted food subsidy program in February 2022.

Non-agricultural

sectors:

During the fiscal year 2018-19, the inflation rate in

Pakistan was 3.93 per cent, the highest in four years. This was driven by a

weaker exchange rate and surging global commodity prices. The State Bank of

Pakistan (SBP) raised the policy rate by 275 basis points. The government also

approved the Supplementary Finance Bill in January 2022.

The banking sector has been strengthened. Foreign investors

can invest up to 100 per cent of their equity in most sectors.

This allows them to remit their profits without any restrictions. There has

also been a substantial amount of FDI.

The service sector has been growing at an alarming pace.

Most of the workforce is employed in this sector. The service sector is essential in reducing inflation in the short run. The rapid growth of this

sector is driven by population growth.

Cost-push

inflation:

Considering the current situation of the Pakistan economy,

the cost-push inflation rate of 3.93 per cent in the year ended March 31 is not

too surprising. However, the real question is how does this figure compare to

the inflation rates recorded in the years before and after?

The cost-push effect is the result of the increased prices

of imported goods. The import price of goods is a function of three factors:

money supply, electricity and manufacturing value-added.

The cost-push effect will be most visible after the average

production cycle has been completed.

The other important variable in the cost-push puzzle is the

price of imported goods compared to domestic prices. The exchange rate also has

a considerable influence on imported inflation.

Short-term

pressures:

Various factors affect the inflation rate in Pakistan. Some

of the factors that affect the rate include:

The inflation rate is affected by the exchange rate. The

exchange rate is crucial because it influences the prices of imported goods,

exported goods and tradable services. A stronger dollar will make imports more

expensive.

The inflation rate is also affected by a rise in energy

prices. Higher energy costs result in a surge in consumer prices. Similarly,

higher wages translate into increased demand for goods and services.

Floods have destroyed wheat crops, cotton crops and rice

crops in Pakistan. The resulting disruptions to agricultural production have

put inflationary pressures on the market.

Long-term

growth:

Increasing prices of essential goods are restricting

household spending. The World Bank attributed Pakistan's inflation rate to

rising costs of domestic energy and flood disruptions.

The agriculture sector has been a contributor to inflationary pressures. Pakistan's agricultural output has increased at a

slower rate than non-agricultural sectors. This has caused an overall decline

in the economic importance of the industry.

.

|

| Inflation Rate in Pakistan |

The service sector accounts for 61.7% of the GDP, with

finance and insurance accounting for 24%. The largest corporations in the

economy are involved in automobiles, cement, telecommunications, utilities and

food. The government has taken steps to promote modern service industries

through incentives and long-term tax holidays.

Author Bio:

Carmen Troy is a research-based content writer for Splash sol,

a globally Professional

SEO firm and Research Prospect, The UK's most trusted

dissertation writing service. They provide Custom Dissertation writing services,

Dissertation

proposal writing Help and

many more services to students of all levels, and their experts are all

UK-qualified. Mr Carmen holds a PhD degree in mass communication. He

loves to express his views on various issues, including education, technology,

and more.

Comments

Post a Comment